A new study found that 84 percent of business travelers expect to take at least one trip to attend conferences, conventions or trade shows in the next six months. According to "The Quarterly Business Travel Tracker," while less than one in 10 U.S. business travelers are uncertain if they would travel in the next six months, the top reason for uncertainty was that meetings and events are not occurring. Corporate policies restricting business travel contributed as the second-highest reason for uncertainty.

Business travelers also likely to resume traveling at a slightly slower pace compared to pre-pandemic levels, averaging about 1.6 trips per month (compared to 1.7 monthly trips prior to the pandemic).

The release of these findings corresponds to Global Meetings Industry Day (GMID) April 7, where organizations around the world spotlight the tremendous positive impact created by business meetings, trade shows, incentive travel, exhibitions, conferences and conventions on people, businesses and the economy. Powered by the U.S. Travel Association and the Meetings Mean Business Coalition, GMID has special significance this year as the meeting and events industry moves beyond the pandemic-era trends of virtual and hybrid meetings and returns to live, in-person events.

While U.S. Travel forecasts that business travel spending was still down 60 percent from pre-pandemic levels in 2021, the "Quarterly Business Travel Tracker’s" latest data shows a clear shift in American business travelers’ desire to return to in-person meetings.

“While the data indicates a strong desire from American business travelers to hit the road again, there is a big difference between willingness to travel and actually taking a trip,” said Roger Dow, president and CEO of U.S. Travel. “Corporate leaders should seize the competitive advantage, budget for business travel, and encourage their teams to get back on the road and reestablish those personal connections that only come with face-to-face interactions.”

Another component of the Quarterly Business Travel Tracker, a newly developed current and forward-looking Business Travel Index, shows that while business travel activity slowed somewhat in Q1 2022, business conditions for travel such as GDP and business investment are quite favorable, reaching an index of 105 for Q2 2022 (2019=100).

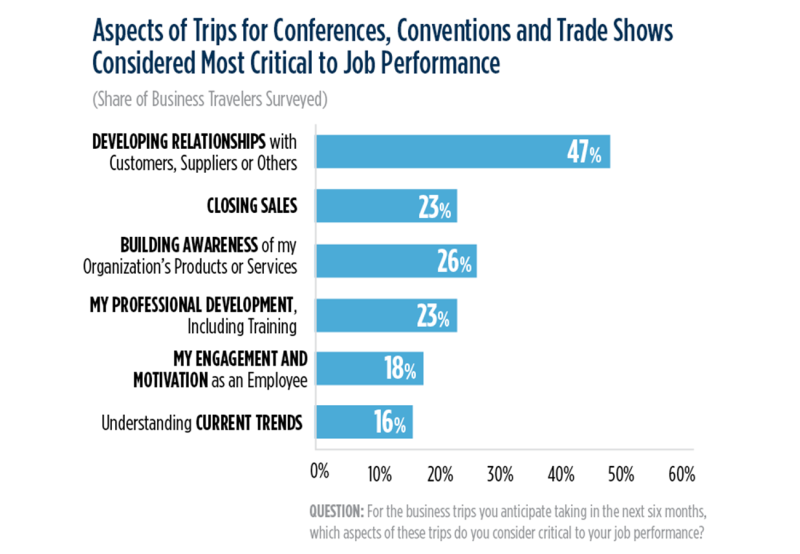

“In-person conferences have relational and financial impacts to corporations that are significant,” said Andrea Stokes, practice lead for hospitality at J.D. Power. “Nearly half of survey respondents indicated that conferences, conventions, and trade shows are critical to developing relationships with customers, suppliers or others. Nearly one in four respondents indicated these events are critical to closing sales.”

Federal lawmakers can also advance policies to accelerate the recovery of the meetings and events sector. U.S. Travel Association is calling on Congress to enact policies to help revive business travel spending in restaurants and entertainment venues, while also urging the Biden administration to remove remaining travel restrictions to facilitate a faster return to international business travel.

Source: U.S. Travel

Related Stories

International Delegates Return in Strong Numbers for IPW 2022

Survey: Return of Business Travel More Important Than Ever